About KNI

New Ventures Specialists

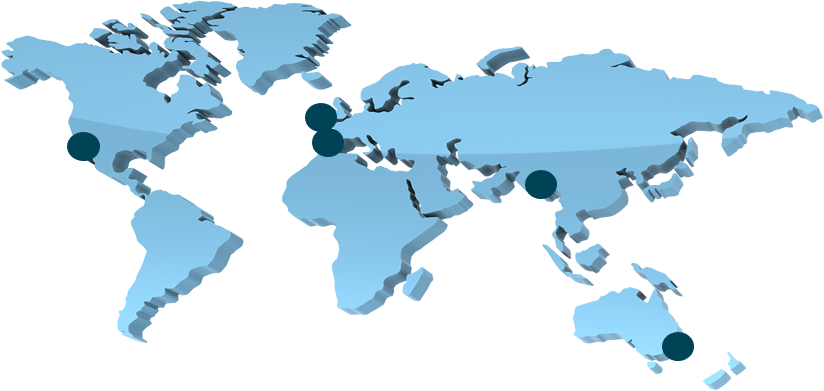

- A multi-disciplinary, multi-lingual team of over 200 professionals across four continents

- Our new ventures teams combine the best of both: financial services domain experts and entrepreneurs with deep startup and fintech experience

- Our global footprint enables 24 /7 delivery to bring new ventures to market much faster than our clients could working alone

- Founded in 2005 by financial services, software executives & startup specialists