Introduction

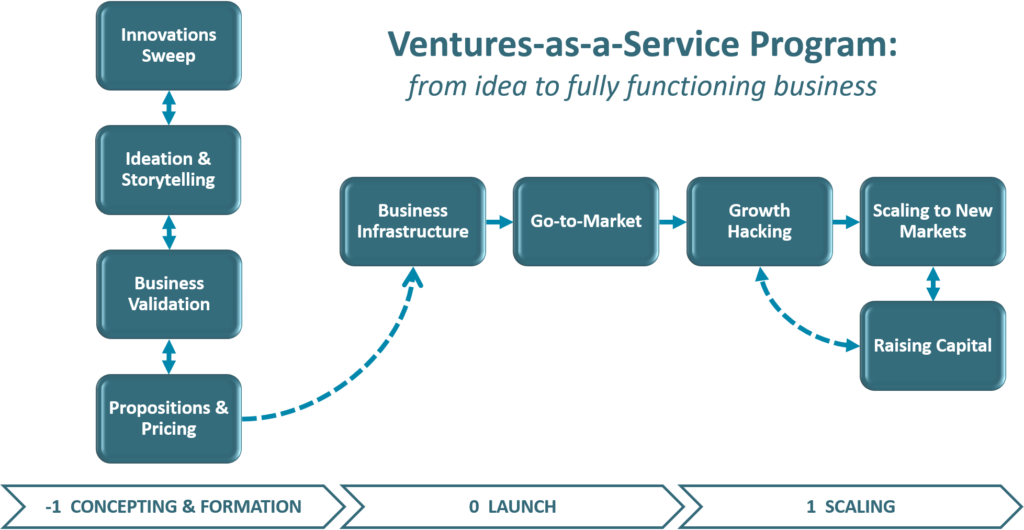

What is 'Ventures-as-a-Service'?

A service that helps organizations to develop, launch and scale new ventures.

We think of ventures as new products or services, entire new business spin-outs or the creation of a new business unit within the organization.

We are industrializing the corporate ventures experience using our repeatable processes, learned from many startups and new products we’ve launched over the years, to professionally manage an organization’s portfolio of innovations.

This service enables organizations to dramatically improve their ability to monetize their innovations.